Former PIKOM chairman takes Netccentric to higher profitability level

25 Aug 2021

NETCCENTRIC DELIVERS STRONG H1 FY2021 FINANCIAL RESULTS WITH 60% REVENUE GROWTH (YOY)

25 Aug 2021Netccentric delivers strong H1 FY2021 with revenue climbing 60%

HIGHLIGHTS:

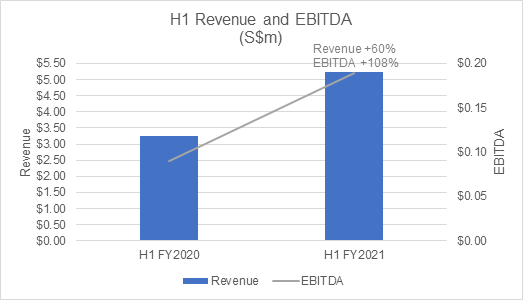

- Strong revenue growth in the half year (“H1”) ended 30 June 2021, with revenue +60% year-on-year (YoY) to S$5.23 million (A$5.16 million), driven by growth across the Group’s business units.

- H1 FY2021 EBITDA more than doubled YoY to S$0.19 million (A$0.19 million), excluding extraordinary expenses relating to the issue of options, M&A activities and forex movements.

- Netccentric’s 100% owned subsidiary, Nuffnang Malaysia, delivered a strong contribution to the H1 FY2021 results of S$2.51 million (A$2.48 million) with Q2 FY2021 revenue of S$1.34 million (A$1.32 million), representing year-on-year growth of 65% and quarter-on-quarter growth of 14%.

- Nuffnang Malaysia pipeline continues to grow, with orders in H1 FY2021 up 88% to S$3.00 million (A$2.96 million) compared to H1 FY2020. This complements and empowers the Group’s expansion into social commerce.

- Netccentric retains a strong position to drive continued growth both organically and via M&A with a healthy debt-free balance sheet, S$5.43 million (A$5.36 million) in cash and a proven strategy to deliver end-to-end growth solutions.

Social commerce platform provider Netccentric Ltd (ASX: NCL, “Netccentric” or “the Group”) is pleased to provide the Group’s financial results and update for the half-year ended 30 June 2021 (H1 FY2021).

Financial Highlights

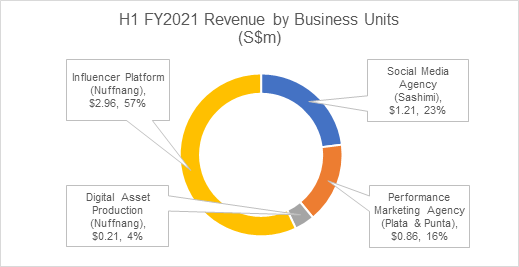

Netccentric achieved revenue of S$5.23 million in H1 FY2021, up 60% compared to H1 FY2020 and driven by strong growth across the Group’s business units which built momentum into Q2 FY2021. H1 FY2021 revenue for Influencer Platform (Nuffnang) increased by 49% year-on-year (“YoY”) to S$2.96 million, Social Media Agency (Sashimi) increased by 52% YoY to S$1.21 million and Performance Marketing Agency (Plata & Punta) increased by 126% YoY to S$0.86 million.

Gross profit grew by 34% YoY to S$2.23 million. The Group delivered H1 FY2021 EBITDA of S$0.19 million (H1 FY2020: S$0.09 million), a YoY increase of 108%, excluding the impact of extraordinary expenses relating to the issue of options, M&A activities and forex movements.

Although the Group delivered a H1 FY2021 net loss before tax of S$1.51 million, this was due to non-cash items related to share options expense (associated with the placement the Group conducted in February 2021), employee share options and forex movements amounting to S$1.56 million. Excluding these non-cash expenses, the Group would deliver a profit before tax of S$0.05 million (H1 FY2020: loss before tax of S$0.01 million).

In H1 FY2021, the Group consumed net operating cash of S$0.26 million, with the consumption a byproduct of Nuffnang’s strong revenue growth and associated working capital cycle, with certain campaigns involving payment of influencers prior to collection from clients.

Netccentric entered H2 FY2021 with S$5.43 million in cash and no debt, providing strength and flexibility to fund the Group’s growth objectives.

The Group’s financial results reflect a continuing strengthening as the business gains scale and management executes Netccentric’s growth strategy.

Strategic and Operational Highlights

In H1 FY2021, Netccentric reinforced its status as a pioneering and established provider of social media influencer marketing solutions as the Group expects to gain traction with its innovative social commerce platform, Nuffnang Live Commerce in H2 FY2021. As this traction builds, the Group’s growth in H1 FY2021 continued to be substantially driven by its core social influencer and content marketing platform, Nuffnang.

Through Nuffnang, Netccentric provides engagement and ambassadorship opportunities to global brands through its pool of more than 15,000 influencers, key opinion leaders, celebrities and content creators who offer a collective reach to more than 20 million engaged social media followers throughout Southeast Asia.

Nuffnang Malaysia delivered revenue of S$2.51 million in H1 FY2021 with S$1.34 million in Q2 FY2021, demonstrating year-on-year growth of 65% compared to H1 FY2020 and quarter-on-quarter growth of 14% compared to Q1 FY2021.

The business unit’s pipeline also continued to grow, having achieved 88% growth in orders for H1 FY2021 compared to the same period last year, reaching S$3.00 million (H1 FY2020: S$1.60 million) and carrying strong momentum into H2 FY2021. Orders are defined as insertion orders that have been signed by clients. Nuffnang Malaysia’s revenue profile remains substantially recurring in nature, with 79% of H1 FY2021 revenue coming from recurring clients.

Revenue growth was boosted by significantly increased spend from anchor clients including KFC, Unilever and in particular, Dutch Lady Milk Industries, which increased its spending by 11x in Q2 FY2021 over Q2 FY2020.

The Group’s increased revenue run rate in Q2 has aligned with broader platform improvements, with the launch of Netccentric’s Campaign Management Platform which rolled out to select clients during the quarter. The platform links all three key stakeholders – clients, influencers and internal teams – to deliver greater efficiency to brands and smoother workflow for influencers. API integration with Facebook allows the platform to facilitate automated extraction of campaign data, which allows clients to better monitor the performance of their campaigns.

Elsewhere within the Group, the strong revenue growth delivered by social media agency Sashimi was attributable to optimisations including upscaling of its data analytics and marketing-tech capabilities, and the Group’s performance marketing agency Plata & Punta saw strong growth driven by increased media spend from key eCommerce clients.

An example of this growth is with an eCommerce-focused baby products business which is a Plata & Punta client, where government-enforced lockdowns drove bolder steps on digital advertising. The Group saw an increase of 3-4x in the client’s media spend, which resulted in a 3x increase in return on advertising spend.

This growth is complemented by further development of the Group’s Nuffnang Live Commerce business, a platform which turns the engagement between social media influencers and their followers into revenue and sales. The platform moves consumers from awareness to the purchase stage instantaneously, as viewers can use their devices to immediately purchase advertised products from an influencer’s live video stream.

Netccentric Executive Chairman, Ganesh Kumar Bangah (pic above), said:

“We are pleased to have delivered rapid growth in revenue and underlying earnings, particularly in our core influencer and content marketing business through the most recent quarter and half-year. We have set ambitious objectives to expand in this high-growth market, and we believe our execution of the Group’s strategy has allowed us to deliver on our promises with scale benefits beginning to show in our bottom line.

“The rapid growth in revenue and deal pipeline that we are achieving, not just through Nuffnang Malaysia but across our Group, indicates the strength of our diversified model and our strategic initiatives. We look forward in H2 FY2021 to continuing to enhance the functionality of our platform and promote growth in engagement, total transaction value and revenue to Netccentric.”

This announcement was approved for release by the Netccentric Board of Directors.